The number of the retail investors in India is growing at a very rapid pace, especially during the Covid-19 scene. The major reason for this unprecedented rapid growth could be the FOMO (fear of missing out) effect where all such investors do not wish to lose out any opportunity to make money by trading.

Also, the major job losses during the covid-19 scene have compelled the unemployed segment to look out for all possible alternatives to earn money and thanks to the aggressive marketing moves of all the stock broking houses that claim to charge the lowest or Zero brokerage charges on the trades done over their platform, therefore it is necessary to read about the Best Demat account for beginners in 2022 in detail.

Now, just in case if you tend to follow the stock market news you must be aware of the stock market crash of March’20 where all the major stock markets of the world fell miserably after the WHO declared the COVID-19 as pandemic.

On 16th March’20 Dow fell by around 3000 points, losing 12.9% where trading had to be halted by the New York stock exchange several times, between 12th Feb-23rd Mar’20 Dow lost 37% of its value, the investors lost 30% of their retirement savings in just 2 weeks.

In India on 23rd March’20 Sensex lost 3934.72 points losing 13.15% in a single day, similarly NIFTY lost 1135 points and lost 12.98% on the same day.

However, the sell off panic gripped the market during the same period and people feared further degradation of their invested money in the stock markets. But as they say, every slump in the stock market creates the room for entering into the stock markets with fresh positions and bright future hopes of making huge capital gains out of the invested money when the situations are restored back to normal.

It was only after a few months the stock market began to recover and all the money invested during this major sell off event in March’20 doubled by Feb-March’21.

There have been many stocks that have even swelled more than 200-800% from past 1 year

Some of the examples of exponential growth of shares during 1 past year is as below:

- CG POWER & INDUSTRIAL- Grew by 822%

- HFCL-Grew by 529%

- JSW ENERGY- Grew by 433%

- INTELLECT DESIGN- Grew by 376%

- ECLERX SERVICES- Grew by 369%

Now, just imagine the value of your investments as on today, if you had invested in any of these stock in past 1 year.

Did you miss the bus to grow your investments exponentially by investing in the right stocks?

Well worry no more, as they say the best time to plant a tree was 20 years back and the next best time is now, so by not wasting further time now, simply get your demat account opened with one of the best stock brokers available in India and invest in the right kind of stocks to make your money work for you.

Now let me guess, you are confused about the following questions:

- Which is the best stock broker to start trading with?

- Are there any joining fees involved in opening a demat account?

- Which broker charges the least commission rates?

- Do I have to pay the Annual maintenance charges?

- What is demat and trading account

Well, your concerns are quite genuine but don’t worry we are here for your rescue, we will help you to understand the basics of the stock market.

Well, firstly let’s understand “What is demat and trading account”

Demat account: The Demat account is much similar to your bank account wherein you keep your traded securities, bonds etc. It is an account that keeps your traded or bought shares in electronic form with any of the two depositories of India i.e. CDSL &NSDL.

If you dig deeper into the history, you will find out that before 1996 shares were physically held in share certificate form that were exposed to a number of risks such as it might be lost, or get stolen, or might get torn so to overcome this drawback the depositories came up with a revolutionary idea of holding shares in electronic form and all the share certificates could now be converted into electronic form and now could be traded over exchange digitally. This process was named as dematerialisation of share certificates.

So by now you might have understood that Demat account is nothing but a short form of Dematerialization account where the shares are held in electronic form.

How to open a demat account?

A demat account can be opened by approaching a depository participant or a registered stock broker that is registered with SEBI under sub section 1A of section 12 of SEBI Act.

Who is a depository participant?

As discussed earlier too, there are 2 depositories in India CDSL &NSDL and any entity that is a agent of any of these two depositories and is registered with SEBI under sub section 1A of section 12 of SEBI Act is known as a depository participant. The relationship of the depository and the DP is governed by an agreement under the Depositories Act.

SEBI (Depository &Participant) Regulations 1996 define a minimum net worth of Rs. 50 lakhs for the stock brokers, Registrar &Transfer agents & NBFCs, for giving them a certificate of registration to act as DPs.

If a stockbroker wishes to become a DP in more than one depository, then he has to comply with the specified net worth criteria separately for each such depository.

Shares Trading Account:

Before the advent of era of digitalization, the buying and selling of shares took place through an open outcry system where the traders with the help of gestures and verbal communication carried out their trades.

Later with the introduction of digitalization the stock brokers offered the facility of placing the buying and selling orders for shares through an electronic medium and this electronic medium could be used by opening a trading account with any of the stock broker that issued a unique trading account number to the investor.

The trading account is linked to the demat account of an investor where the instructions to the stock brokers are given through an electronic medium to either buy or sell the shares and the subsequent process of shares addition or deletion shall take place from the demat account as per the instruction of the broker.

Hence a trading account is only a medium by which an electronic request can placed to a broker to either buy or sell shares in the shares market.

Thus, a trading account is opened with the stock broker who is registered with SEBI and the same provides an electronic facility to the investors to place the buy or sell orders with it to be fulfilled in the stock market upon the request is sent further by the broker to the exchange.

Now, once the buying process is complete the shares owned by the investor will now be stored in a separate account known as a Demat account in an electronic form, that might be held with any of the depositories of India such as CDSL or NSDL.

Similarly in case of selling of shares the shares are sold from the demat account through an electronic request.

Top 10 Demat Account Brokerage Charges Comparison in India

| Stock Brokers | Charges per Trade | Delivery Charges |

| Zerodha | Rs 20 per trade | Rs. 0 |

| Upstox | Rs 20 per trade or 0.05%(whichever is lower) | Rs. 0 |

| 5Paisa | Rs. 20/ trade- Standard plan (No Monthly fees), Rs. 10/trade-Power Investor Pack (Rs. 499 monthly fees) & Ultra Trader pack (Rs. 999 monthly fees) | Rs. 20/ trade- Standard plan, Rs. 10/trade-Power Investor Pack Rs. 0-Ultra Trader pack |

| AngelOne | Rs 20 per trade or 0.25% whichever is lower | Rs. 0 |

| IIFL Securities | Rs. 20/trade | Rs. 0 |

| Motilal Oswal | 0.05% – Standard pack, 0.04%- (Value pack VP2KLT), 0.01% -(Value pack VP1LACT) | 0.50% – Standard pack, 0.40%- (Value pack VP2KLT), 0.10% -(Value pack VP1LACT) |

| Share khan | 0.1% on 1st leg and 0.02% on the 2nd leg (minimum brokerage of 5 paise per share.) | 0.50% or 10 paise per share or Rs 16 per scrip whichever is higher (minimum brokerage fee of 10 paise per share) |

| ICICI Direct | 0.025 to 0.055% | 0.09% to 0.55% |

| HDFC Securities | 0.10% or min Rs.25 both buy & sell | 0.50% or min Rs.25 |

| SBI Securities | 0.05% on both legs | 0.50% |

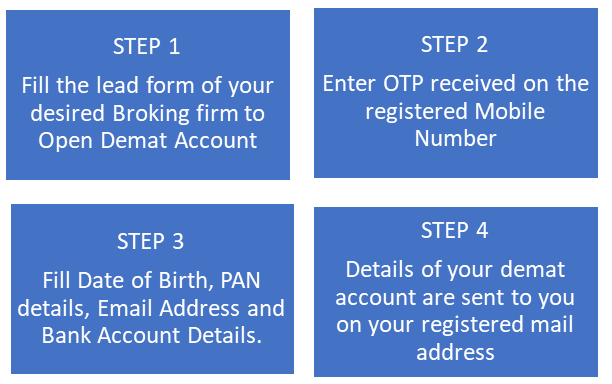

There are 4 simple steps in opening your Demat account with any of your desired broking firm:

I prefer using AngelOne account for trading because it charges very reasonable and minimal rates from its users also the application is user-friendly and the Annual Demat Maintenance charges are just Rs.20/per month.

Earn Cashback upto Rs. 2000 on account opening

AngelOne offers cashback upto Rs. 2000/- on opening account with it and upon opening refferal account of your friends, family or anyone it offers cashback upto Rs.5000/-

So you too can open a free account with AngelOne by clicking here and the downloading application by using my referral code UD1012MAS and get cashback upto Rs.2000/-

Disclaimer: Please form your decision to open a demat account with any of your desired broking firm after a detailed inquiry has been done by you personally for to gain best results, as stock market is subject to risks.

Also read: Cheap & Best hosting and domain provider in 2022

Create your own website with Hostinger with best hosting and domain rates.

Click here for best and special offers.

I absolutely love your site.. Very nice colors & theme. Did you develop this site yourself? Please reply back as I’m wanting to create my own blog and would like to find out where you got this from or what the theme is called. Many thanks!

Hi, Thanks for visiting my website. Please send your query through our contact us form. We will try to get back to you soon.

May I just say what a comfort to find a person that truly knows what they are discussing online. You definitely realize how to bring a problem to light and make it important. A lot more people need to check this out and understand this side of the story. I can’t believe you are not more popular since you definitely possess the gift.